Our Clients

We primarily work with high-net-worth individuals and business owners. Our team is a group of financial advisors who listen to their clients’ needs and provide highly personalized long-term investment strategies.

Here’s how our process typically works:

- Establish and define the relationship

- Gather client information and goals

- Evaluate the client’s current financial status

- Review overall financial goal projections

- Develop and present recommendations and/or alternatives

- Implement the agreed upon recommendations

- Review portfolio via quarterly phone conversations (as appropriate)

To employ this process effectively, we take an old-school approach complemented with new technology, which includes:

- A complete understanding of our client and their portfolio using the Stifel Wealth Strategist Report® combined with cutting-edge client reporting software

- Trustworthy custodianship of clients’ hard-earned savings

- Professional asset management

- High-quality service

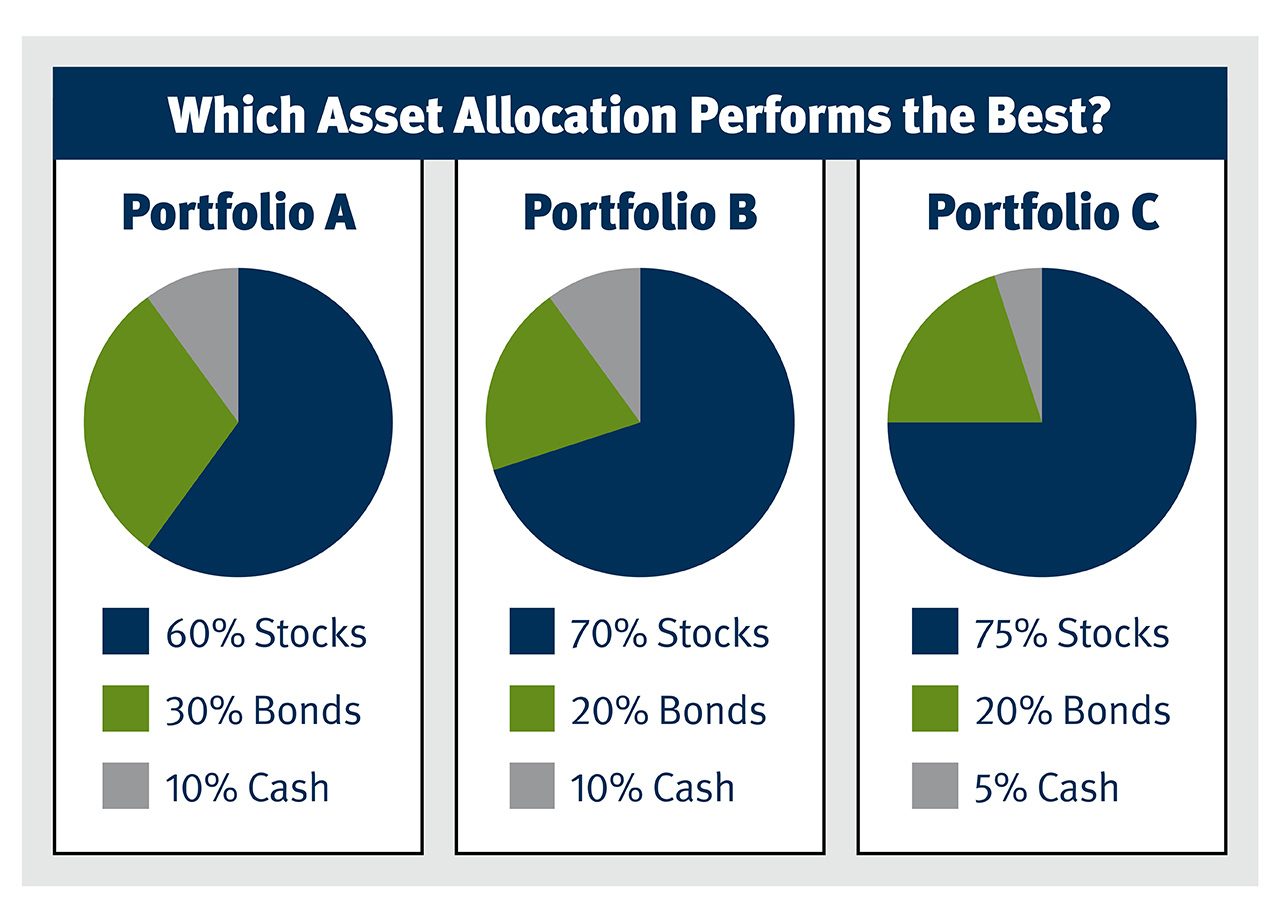

Our Yin and Yang Philosophy

Like the yin and yang symbol, a portfolio has a similar graphic, as it’s some blend of fixed income, equity, and cash (traditionally). Blending a portfolio is no different than finding the right blend that reflects your life’s balance.

Our Active Asset Allocation Approach

Our approach addresses what’s right in front of us, while also having a steady eye to the future:

- Define our client’s long-term income needs and investment goals.

- Establish a long-term target asset allocation.

- Identify fairly priced investments with a history of producing steady returns.

- Recommend clients stay with those investments as long as those characteristics remain in place. If those characteristics start to fade, recommend reducing that position.

- Look for new investments with positive characteristics.

- If no new investments can be found at a certain time, recommend waiting to secure short-term securities until new positive characteristic investments emerge.

Asset allocation does not ensure a profit or protect against loss.